Condo Insurance in and around Everett

Looking for outstanding condo unitowners insurance in Everett?

Cover your home, wisely

- Mill Creek, WA

- Clearview, WA

- Snohomish County

- Snohomish, WA

- Bothell, WA

- Mukilteo, WA

- Eastmont, WA

Your Possessions Need Coverage—and So Does Your Condo Unit.

As with anything in life, it is a good idea to expect the unexpected and try to prepare accordingly. When owning a condo, the unexpected could look like damage to your most personal possessions from smoke fire, freezing pipes, and other causes. It's good to be aware of these possibilities, but you don't have to fret over them with State Farm's great coverage.

Looking for outstanding condo unitowners insurance in Everett?

Cover your home, wisely

State Farm Can Insure Your Condominium, Too

Our daily plans never block time for troubles or disasters. That’s why it makes good sense to plan for the unexpected with a State Farm Condominium Unitowners policy. Condo unitowners insurance protects more than your condo's structure. It protects both your condo and the things inside it. In the event of a burglary or falling trees, you could have damage to some of your belongings in addition to damage to the structure itself. If you don't have enough coverage, you might not be able to replace your valuables. Some of the things you own can be replaced if they damaged even beyond the walls of your condo. If your car is stolen with your computer inside it, a condo insurance policy could cover the cost.

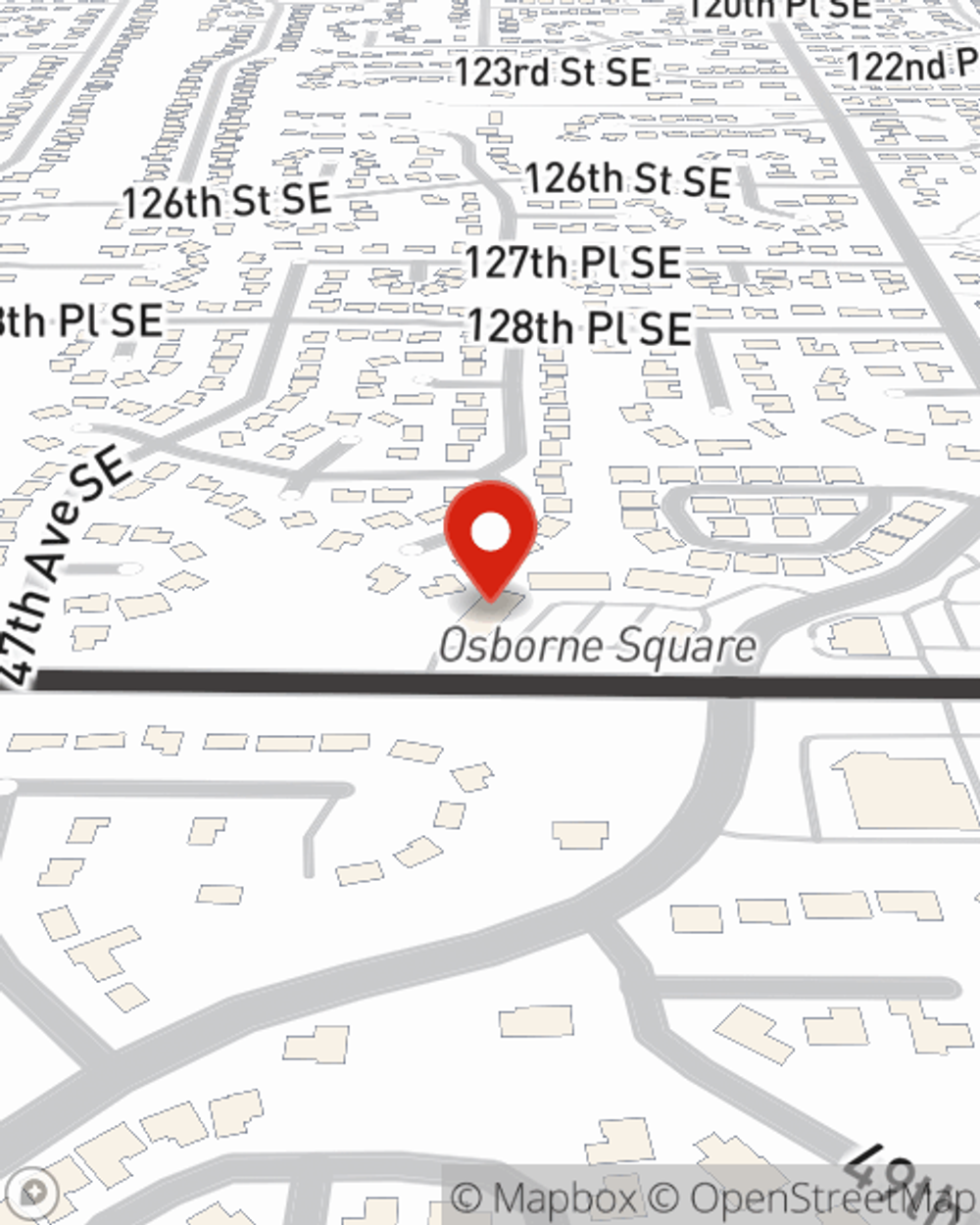

Fantastic coverage like this is why Everett condo unitowners choose State Farm insurance. State Farm Agent Mike Ramirez can help offer options for the level of coverage you have in mind. If troubles like wind and hail damage, drain backups or identity theft find you, Agent Mike Ramirez can be there to assist you in submitting your claim.

Have More Questions About Condo Unitowners Insurance?

Call Mike at (425) 823-2500 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

Mike Ramirez

State Farm® Insurance AgentSimple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.